New Rule for International Credit Card Users:

On May 16, 2023 the Ministry of Finance issued a notification mentioning to omit rule 7 of the Foreign Exchange Management (Current Account Transactions) Rules, 2000. They shall come into force on the date of their publication in the Official Gazette, according to the notification.

What Changes:

Spending in foreign exchange through international credit cards will be covered under the RBI’s liberalised remittance scheme (LRS), which has brought credit card spending outside India under the LRS.

As a result, the special privilege that international credit cards enjoyed earlier will no longer be available and they will be treated at par with other money transfer instruments. The only exception to this amended LRS rule will be applicable for payments made through money held in RFC account in a bank in India.

What must Indians now keep in mind when using an international credit card in a foreign land?

Effective July 2023, Indian travellers booking international travel outside of India will encounter a significant change of a 20% tax collected at source (TCS). This tax will be collected by authorised banks or travel agents for international travel tour bookings and now on credit cards.

It is essential for Indian travellers to factor in this additional financial obligation while making payments for overseas travel which may increase the overall expenditure for their trip. However, travellers can claim TCS credit while filing their tax return, which means that the net impact on their travel costs will not change.

Now, Let’s understand what is TCS, LRS and FEMA.

Tax Collection at Source (TCS)

Tax collected at source (TCS) is the tax collected by the seller directly from the buyer on the time of sale itself and seller will deposit this amount to Tax Authorities.

Example:

- Suppose TCS is 20%.

- If Malav has a Credit Card and he buys following during the year from his international Credit Card.

In February, Iphone from USA 1500 US$ ( Equivalent to Approx 1,20,000 INR )In April , Fees for education abroad 2000 US$ ( Equivalent to Approx 1,60,000 INR)

In May , paid 3000 US$ for foreign trip including stay etc for family. ( Equivalent to Approx 2,40,000 INR )

Same time in May top up Forex card through credit card for US$ 2000 . ( Equivalent to Approx 1,60,000 INR )

Till here Malav spent Forex of Us $ 8500 Equivalent to Approx 6,80,000 INR

Now,

As soon as Malav spent anything more than INR 20,000 ( Equivalent to 250 US$ ) through credit card during the year immediately TCS @ 20% will be applicable. Check below example

In October , Malav ordered an Ipad worth 500 US$ ( Equivalent to Approx 40,000 INR ) and as over all limit on spending on credit card exceeds Rs. 7,00,000 a TCS @ 20% on entire amount spent on credit card will be applicable. Means 20% on INR 7,20,000 i.e. INR 1,44,000 will be the amount of TCS .

Here Malav is buyer and Credit Card company is seller.

Credit Card (seller) will charge extra 20% TCS from Malav (buyer) and his total Credit Card bill of October will be 1,84,000 INR ( 40,000 Ipad + 1,44,000 TCS).

This extra 20% TCS money will be directly paid to Indian Tax Authorities by Credit Card company.

Foreign Exchange Management Act (FEMA)

- This Act was passed in 1999.

- This defines all the rules and regulation about how citizens can use or transfer Indian money outside.

What is Liberalized Remittance Scheme (LRS)?

- LRS is a specific part of Foreign Exchange Management Act (FEMA).

- LRS makes guideline for outward remittance from India by Indian Citizens.

- LRS defines how much maximum money can be remitted overseas by any Indian Citizens Per Year without informing the Reserve Bank of India.

- Remittance done to overseas for Education and Medical purposes doesn’t come under this Rule.

- TCS of 5% will be charged from customer on the Transaction Amount on Debit or Forex Card for overseas Transactions.

- If anyone wants to remit money overseas which is more than LRS Amount Per Year, he has to take prior permission from Reserve Bank of India.

History of LRS

- In 1999, under LRS, every citizen was allowed to remit money overseas up to a maximum of $25,000 Per Year without informing the Reserve Bank of India.

- In 2007, LRS was increased to $50,000 Per Year.

- In 2013, LRS was increased to $2,50,000 (2 Crore Rupees) Per Year.

Who are eligible for LRS?

- Person must be an Indian resident as defined under the Foreign Exchange Management Act (FEMA).

- He must have a valid Passport, PAN card and Bank Account in India.

Benefits of LRS

- A person can invest or transfer money up to a maximum of $250,000 (2 Crore Rupees) Per Year to overseas without informing the Reserve Bank of India.

- LRS also allows Indians to transfer money from India to any foreign country up to a maximum of $250,000 (2 Crore Rupees) Per Year without informing the Reserve Bank of India.

Why LRS required?

- LRS is used to put some Taxes on rich person who are transferring Indian money to overseas.

- If LRS is not implemented, people will earn money in India and they will simple transfer that money to some other country where Tax is very less or no Tax.

- So, in case someone wants to evade Taxes in India and transfers upto maximum of $250,000 (2 Crore Rupees) Per Year to overseas, he first have to pay 20% TCS on total amount.

Example:

- If Malav visits Singapore and uses his Debit or Forex Card for overseas Transactions, he has to pay 20% TCS on the Transaction Amount.

- Malav can use or transfer up to a maximum of $250,000 (2 Crore Rupees) Per Year to overseas without informing the Reserve Bank of India.

- If Malav wants to remit money overseas which is more than $250,000 (2 Crore Rupees) Per Year, he has to take prior permission from Reserve Bank of India.

Liberalized Remittance Scheme (LRS) Amendment 2023:

- Indian government have amended Foreign Exchange Management Act (FEMA) on 16th May 2023.

- Credit Card or International Credit Card has been added under Liberalized Remittance Scheme (LRS).

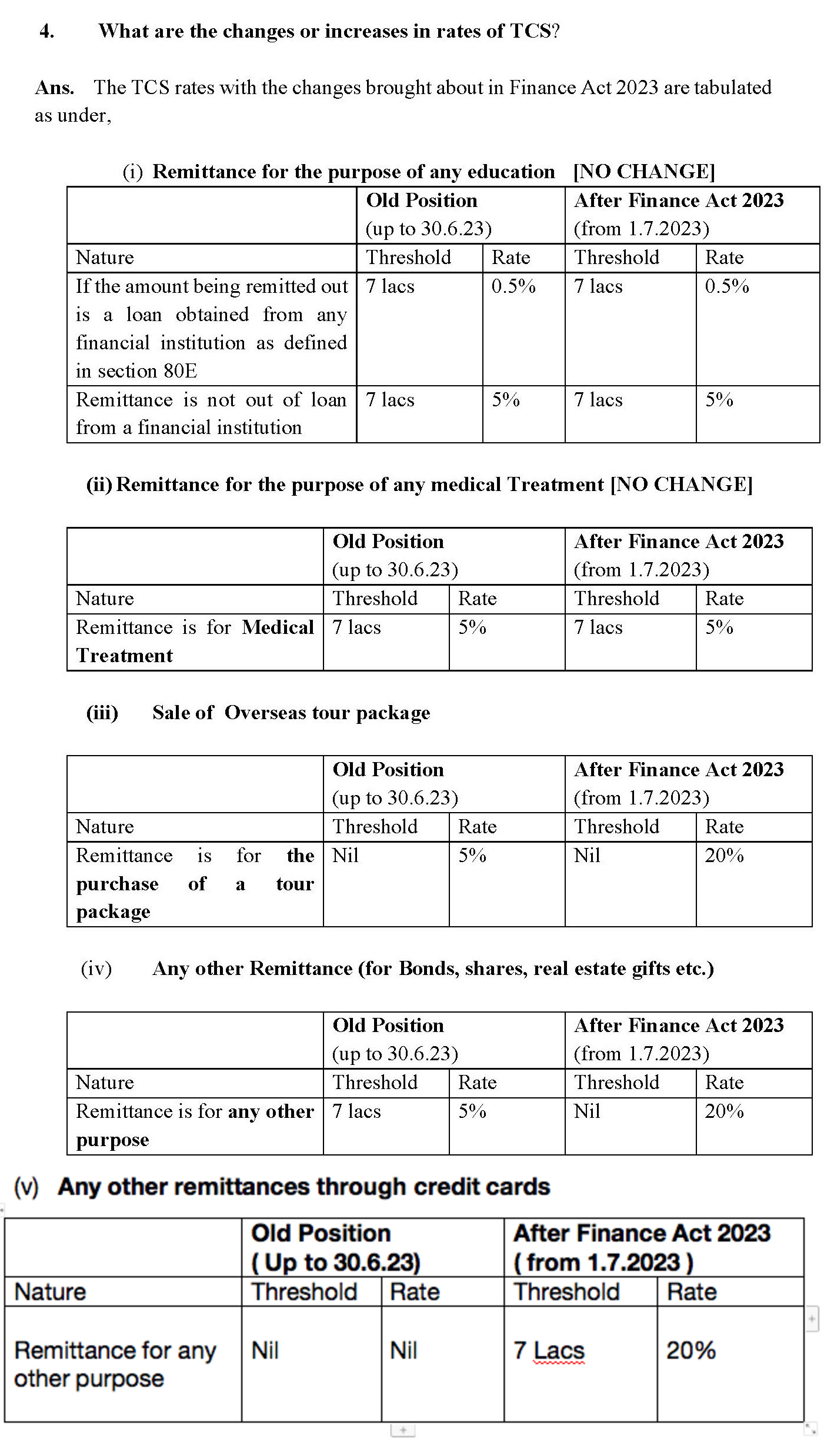

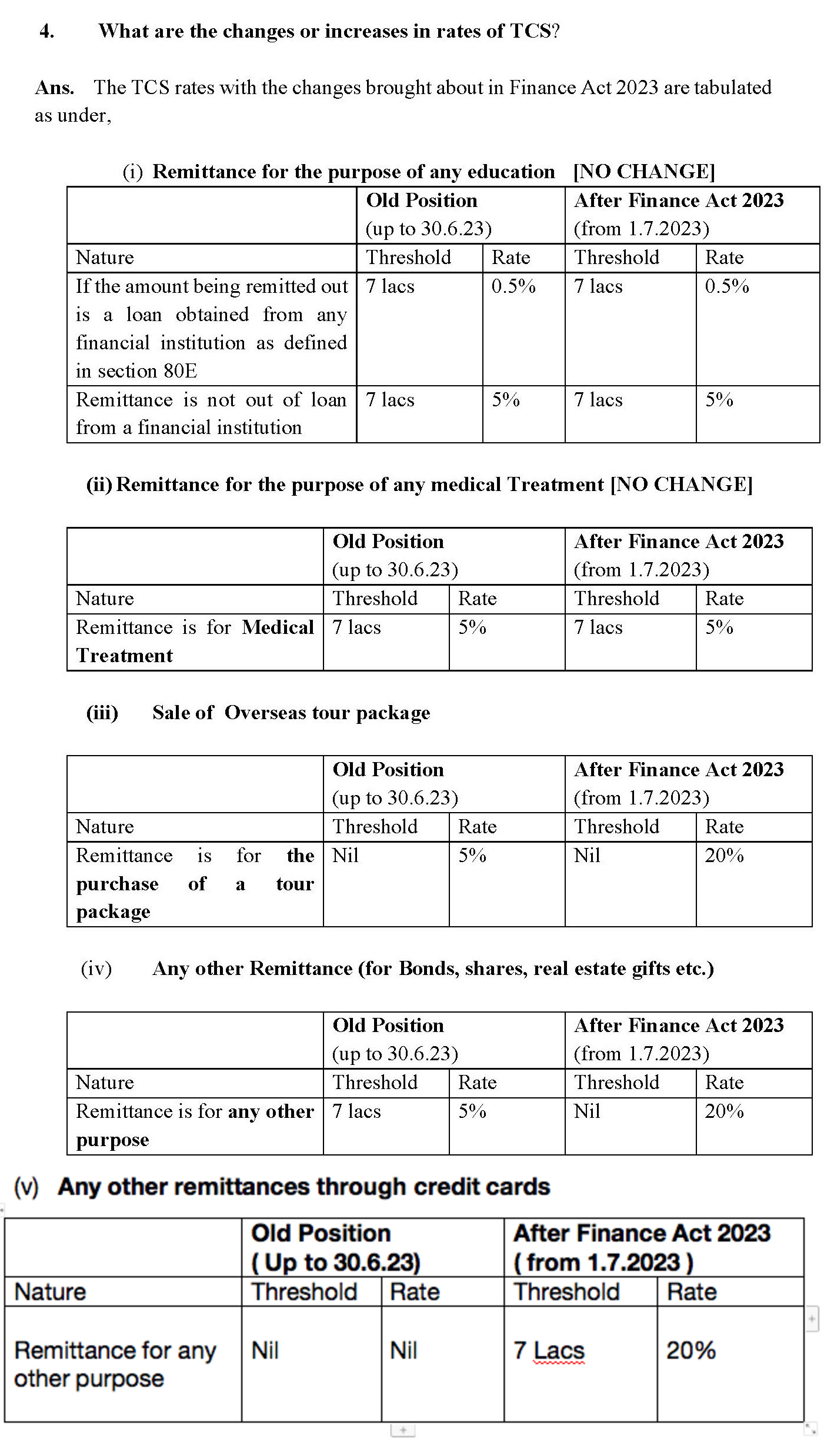

- TCS rate has been increased from the current 5% to 20% effective from July 1, 2023.

Example:

So Basically if Malav visits Singapore and uses his Debit or Forex Card or Credit Card in Singapore, 20% TCS will be charged on all his overseas Transactions if total spending exceeds equivalent INR 7,00,000.

If he buys a Forex Card and loads USD in this Forex Card, still he has to pay 20% TCS will be charged on this amount.

Malav visits Singapore and he has a Credit Card with limit of Rs 10,00,000.

He uses his Credit Card to pay for all transactions in Singapore like Hotels Bills, Shopping, Food and Travelling.

If he spends total 8,00,000 Rupees in Singapore from his Credit Card, Credit Card company will charge 20% TCS from his Credit Card and his total Credit Card statement will be 9,60,000.

Total Spend: 800,000 INR

20% TCS Charged: 1,60,000 INR

Total Credit Card Bill: 9,60,000 INR

Impact of Liberalized Remittance Scheme (LRS) Amendment

- The TCS increase will impact overseas tours and travel packages and increase the cash outflow immediately for travellers.

- The tour operators now will have to collect 20% TCS of the total cost of overseas tour package from the travellers.

- A TCS of 5 per cent will be levied on expenses exceeding ₹7 lakh towards medical treatment and education, while other expenses including investment in real estate, foreign tours, and travel would attract 20 per cent.

- For those availing loans for overseas education, a lower TCS rate of 0.5 per cent would be levied above the ₹7-lakh threshold.